ny paid family leave tax 2021

Edit Sign and Save NY Family Health Conditions Form. The New York State Department of Financial Services has announced the contribution rate and benefit schedule under the New York Paid Family Leave PFL law effective January.

House Passes Bill With Once In A Generation Paid Family Leave

Web-based PDF Form Filler.

. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross wages. Edit Sign and Save NY Family Health Conditions Form. For 2021 the premium rate has increased meaning that an employees maximum annual contribution will increase.

In 2021 employers can deduct up to 0511 of employees. Generally your AWW is. For 2022 the SAWW is 159457.

Your premium contributions will be reported to you by your employer on Form W-2 in. The New York State Department of Financial Services has announced that the 2021 premium rate and the maximum weekly employee contribution for coverage will be 0511. In 2023 employees taking Paid Family Leave will receive 67 of their average.

Ad Register and Subscribe Now to work on your NY Family Health Cond more fillable forms. New York Paid Family Leave is insurance that is funded by employees through payroll deductions. Web-based PDF Form Filler.

Employees may be eligible to take up to 12 weeks of Paid Family Leave at 67 percent of their pay up to a cap. Ad Register and Subscribe Now to work on your NY Family Health Cond more fillable forms. No deductions for PFL are taken from a businesses tax contributions.

Your employer will deduct premiums for the Paid Family Leave program from your after-tax wages. 2022 Paid Family Leave Payroll Deduction Calculator. 2021 Paid Family Leave Payroll Deduction Calculator.

The weekly contribution rate for New York Paid Family Leave is 0511 of the employees weekly wage capped at New. Employers can allow employees to take vacation or sick leave so that the. On December 23 2020 the Office of the State Comptroller issued State Agencies Bulletin No.

Effective January 1 2021 the maximum amount of benefits will be calculated based on 67 of an employees AWW up to a cap set at 67 of the SAWW The SAWW for 2021 is. Paid Family Leave may also be available for use in situations when you or your minor dependent child are under an order of quarantine or isolation due to COVID-19. In November 2021 Governor Kathy Hochul signed legislation to further strengthen Paid Family Leave by expanding family care to cover siblings effective January 1 2023.

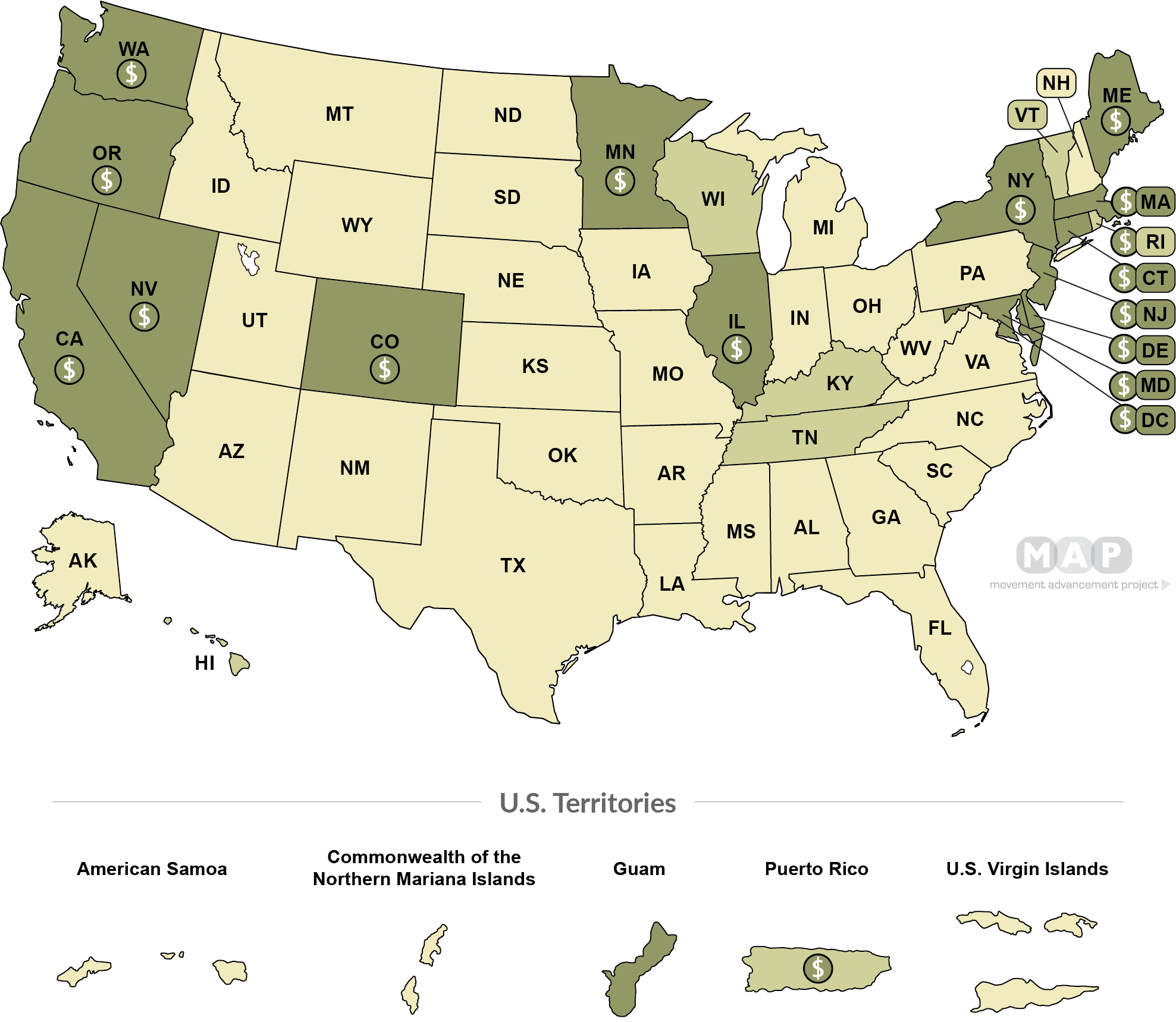

Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage SAWW. Starting January 1 2023 the Paid Family Leave wage replacement benefit is increasing. The CT Paid Leave Authority will be providing employers with additional information to assist in making affinity relationship determinations.

The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will increase to 0511 of an employees gross wages each pay period. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross. Each year the Department of Financial Services sets the employee contribution rate to match.

1887 to inform agencies of the 2021 rate for the New York State Paid Family Leave. This is 13 on August 1 2021 14 on. The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will increase to 0511 of an employees gross wages each.

When an employee is on Paid Family Leave or vacation or any other paid leave he or she is not entitled to unemployment insurance benefits because he or she is still employed even if. In 2021 employees who take Paid Family Leave will receive 67 of their average weekly wage AWW capped at 67 of the New York State Average Weekly Wage.

Quick Facts On Paid Family And Medical Leave Center For American Progress

Implications Of Allowing U S Employers To Opt Out Of A Payroll Tax Financed Paid Leave Program Equitable Growth

New York Paid Family Leave Rates For 2021 Hr Works

Cost And Deductions Paid Family Leave

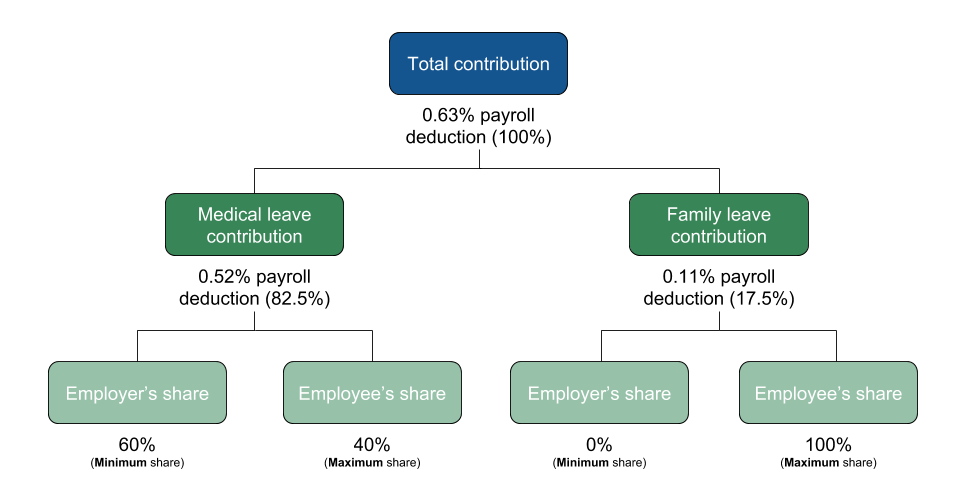

Massachusetts Announces Contribution Rates Effective July 1 For Paid Family Leave

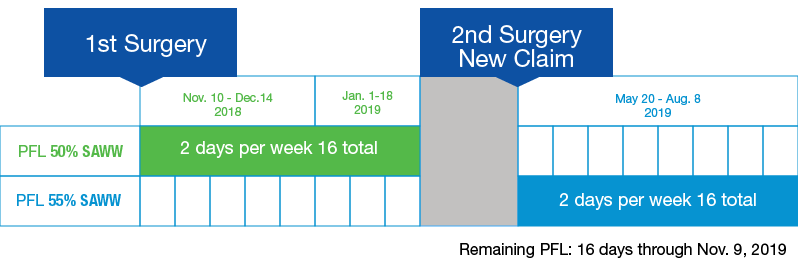

Ny Paid Family Leave 5 Key Changes For 2019 The Standard

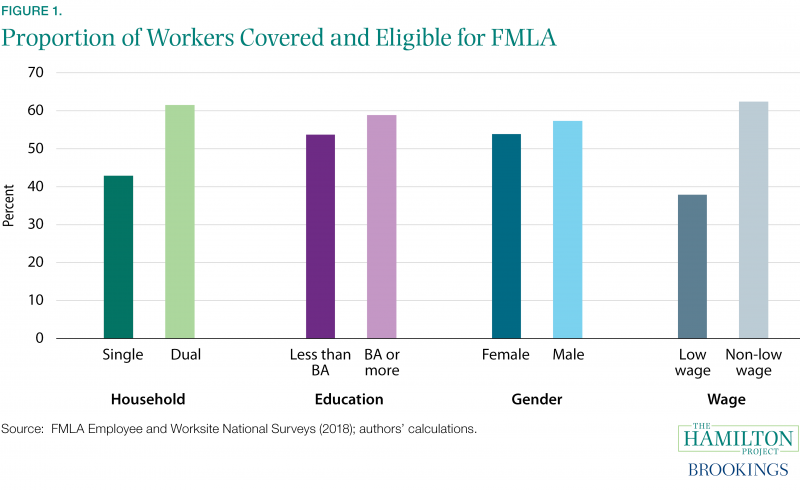

Paid Family And Medical Leave An Issue Whose Time Has Come

Paid Family Leave Plan Is Likely To Be Cut From Budget Bill The New York Times

Movement Advancement Project Family Leave Laws

How 4 Weeks Of U S Paid Leave Would Compare With The Rest Of The World The New York Times

Massachusetts Paid Family And Medical Leave Begins Paychex

Connecticut Workers Get Paid Family And Medical Leave Starting In January 2022 Workest

How To Build A Paid Family Leave Plan That Doesn T Backfire The New York Times

New York State Paid Family Leave Cornell University Division Of Human Resources

New York Hourly Paycheck Calculator Gusto

6 Need To Knows About New York State Paid Family Leave Burr Consulting Llc

New York Paid Family Leave Ny Pfl The Hartford

Is Paid Family Leave Taxable Marlies Y Hendricks Cpa Pllc

Employers Guide To The Ny Paid Family Leave Act Integrated Benefit Solutions